Exploring Ethereum's Future: Why You Shouldn't Ignore It

Written on

Chapter 1: The Case for Ethereum

Have you ever come across tales of individuals who invested early in groundbreaking technologies and reaped massive rewards? For instance, had you invested $1,000 in Tesla back in 2019 at a mere $23 per share, today you would see that investment balloon to around $100,000 (accounting for stock splits). Similarly, those who had the foresight to buy Amazon shares post-dot-com crash at $8 each would have experienced returns up to 500 times their initial stake.

Ethereum, a digital currency held by over 13 million people in the U.S. alone, makes up 40% of all cryptocurrency ownership and has surged by 26% in the past year. Given its substantial market capitalization, rapid adoption, and expanding applications, overlooking this digital currency would be a significant oversight. The potential for growth is immense, but so are the associated risks.

While I’m not claiming Ethereum will yield a 500-fold return, its potential appears far more promising than many other investments available today. It prompts me to ponder why skepticism often accompanies emerging technologies.

We don’t express similar concerns about environmental impacts for established technologies like cars, air travel, or decorative holiday lights. Likewise, we don’t label fine art, currency, gold, or diamonds as schemes of deception.

After extensive research, I believe I’ve pinpointed the underlying reasons for this resistance to innovation. In his book, Innovation and Its Enemies: Why People Resist New Technologies, Professor Juma analyzes the dynamics of innovation, the influence of experts, and the inevitable skepticism and confusion that often arise. Drawing from 600 years of technological history, here are some key insights:

- New technologies are constantly pressured to remain unchanged.

- Resistance to innovation arises when benefits seem to favor a select few (for example, mobile phones were initially luxury items).

- Opposition grows when the public perceives that advantages accrue over an extended timeframe.

- Acceptance of new technology tends to occur only when it doesn't threaten established norms or societal status.

If we swap the phrase "New Technology" with "Ethereum," it paints a clear picture of why many are missing out on this opportunity. Change is often resisted until it becomes the norm, leaving us to wonder how we managed without it.

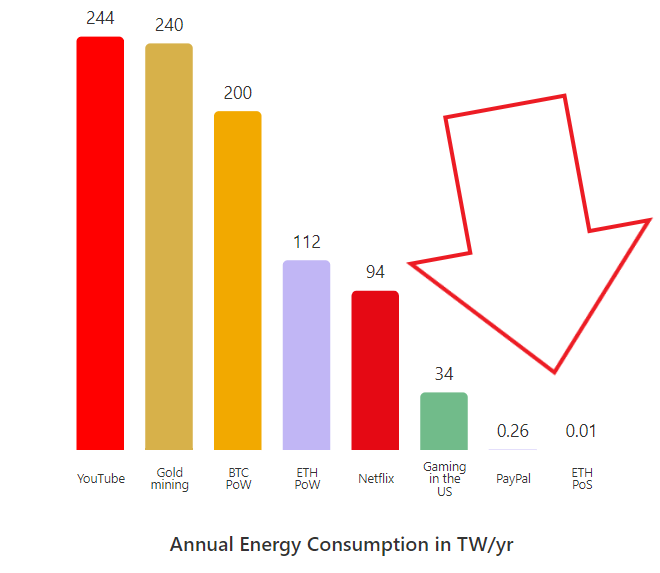

Ethereum is now more energy-efficient than platforms like YouTube and Netflix. The greatest pushback against cryptocurrency, rightfully so, has been its environmental footprint stemming from Proof-of-Work blockchains. However, Ethereum's successful transition to a Proof-of-Stake model has resulted in a staggering 99.5% reduction in energy consumption.

Nonetheless, some environmental advocates continue to argue against Ethereum, clinging to outdated claims even after the significant updates.

Chapter 2: Understanding Ethereum's Value Proposition

The misconception that "Ethereum is a Ponzi scheme" needs to be addressed. A Ponzi scheme is a fraudulent investment model that pays returns to earlier investors using funds from new investors, often promising high returns with minimal risk. In contrast, Ethereum is decentralized with no single point of failure, which protects your investments from fraud. It's a volatile asset, but it doesn’t rely on third parties to manage your holdings.

Ethereum has the potential to become the "internet money," largely due to its innovative smart contract feature, pioneered by co-founder Gavin Wood. Smart contracts are self-executing codes that automate agreements between buyers and sellers, eliminating the need for intermediaries. These contracts enhance transaction traceability, transparency, and irreversibility, which starkly contrasts with the opaqueness of Ponzi schemes.

Ethereum's Depressing Decline discusses the current state of Ethereum and its market challenges, shedding light on the ongoing narrative surrounding this cryptocurrency.

Chapter 3: Future Predictions for Ethereum

While predicting the future is inherently uncertain, we can draw insights from historical trends. Currently, digital assets represent approximately 0.5% of the global money supply. Over the next decade, this percentage is poised to fluctuate. Regulatory measures could diminish this figure, while a more digitally-savvy population might drive it upward.

In my view, taking a long-term perspective suggests that the percentage will increase. Remember, this is not financial advice; invest wisely and only with money you can afford to lose.

This outlook is supported by prominent cryptocurrency experts. The pseudonymous Twitter user Punk6529 has long advocated for using "expected value outcomes" in assessing both Bitcoin and Ethereum.

The TRUTH about this crypto bull run... (PREPARE NOW) examines the recent bullish movements in the cryptocurrency market, providing insights into what investors should expect.

Possible Outcomes

Ethereum's market capitalization currently accounts for around 0.16% of global money supply. Here’s a breakdown of potential outcomes for a $1,000 investment if Ethereum's market share increases:

- 1.6%: $10,000

- 3.2%: $20,000

- 6.4%: $40,000

- 16%: $1,000,000

Ultimately, it is up to you to assess Ethereum's future potential and make informed decisions. If you're interested in more insights on Web3, consider subscribing to support the writers you enjoy. I may earn a small commission if you use my link.

This article is intended for informational purposes only and should not be construed as financial, tax, or legal advice. Always consult a professional before making significant financial commitments.

Subscribe to DDIntel Here.