State of Venture Capital in 2023: Insights and Trends

Written on

Chapter 1: Overview of the 2023 Venture Capital Landscape

In 2023, the venture capital scene was marked by several key narratives, particularly the shift back to a 'new normal'—which may not be so new after all. The years leading up to 2022 can be seen as an exception rather than the rule, with current market dynamics reflecting a return to traditional business practices. In the realm of deep tech (DT), one could easily be distracted by the prevailing trends surrounding GLP-1 and artificial intelligence (AI). However, the year proved to be largely positive, despite adjustments in hurdle rates across various sectors. Below are my overarching observations.

TL;DR: The economic fallout from previous market shifts was more significant than initially thought, but the impact on DT is expected to be less severe. The substantial capital demands of DT companies complicate the distinction between genuine innovation and mere hype. Nevertheless, the persistent demand for these businesses provides a buffer against economic fluctuations. While we anticipate the closure of some underperforming DT firms in the upcoming quarters, this could serve as a necessary market correction. Despite some investor hesitation due to past losses and the lack of favorable public market indicators, promising opportunities continued to secure funding.

Section 1.1: Resilience in Life Sciences

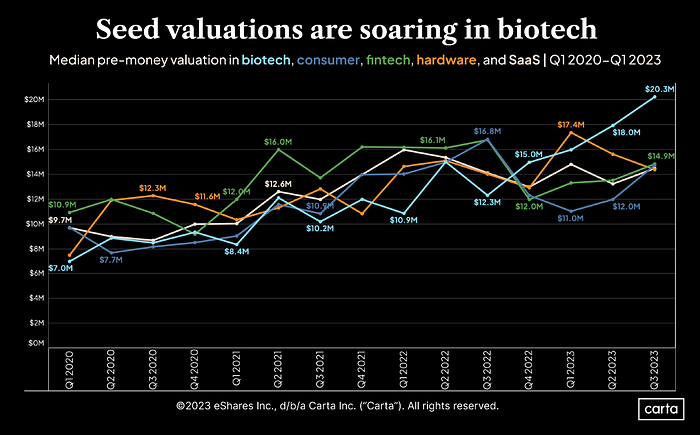

Despite rising interest rates and geopolitical uncertainties, 2023 proved to be a favorable year for early-stage biotech ventures. The ongoing loss of exclusivity (LOE) periods has further fueled mergers and acquisitions (M&A), positively impacting upstream research and development (R&D).

Subsection 1.1.1: The Era of Zero Interest Rates

The Zero-Interest-Rate Period (ZIRP) made risk capital readily accessible, peaking in 2021 during a decade-long trend of high-risk investment. The lower cost of equity, coupled with investor confidence in capital transitions between funding rounds and robust public market demand, created an ideal environment for fundraising, especially for capital-intensive enterprises. Many DT firms successfully leveraged FOMO (fear of missing out) by promoting ambitious visions—regardless of their feasibility—raising substantial amounts before hastily entering public markets through SPACs or IPOs.

Section 1.2: The Market's Shifting Dynamics

As markets turned cautious in 2022, these same companies found it challenging to secure risk capital. Although the failures of highly funded DT companies sent shockwaves through the markets, the economic repercussions may be less severe than anticipated due to the inherent characteristics of DT development and the high barriers to entry for capital.

Chapter 2: Current Trends and Future Projections

The first video titled "State of the Venture Capital Industry" offers a comprehensive overview of the current state of venture capital, exploring key trends and market dynamics influencing investment strategies.

The second video, "Surveying the State of the Venture Capital Market in 2023 with Slauson & Co. ♻️," delves into the specifics of the VC landscape in 2023, highlighting expert insights on emerging opportunities and challenges.

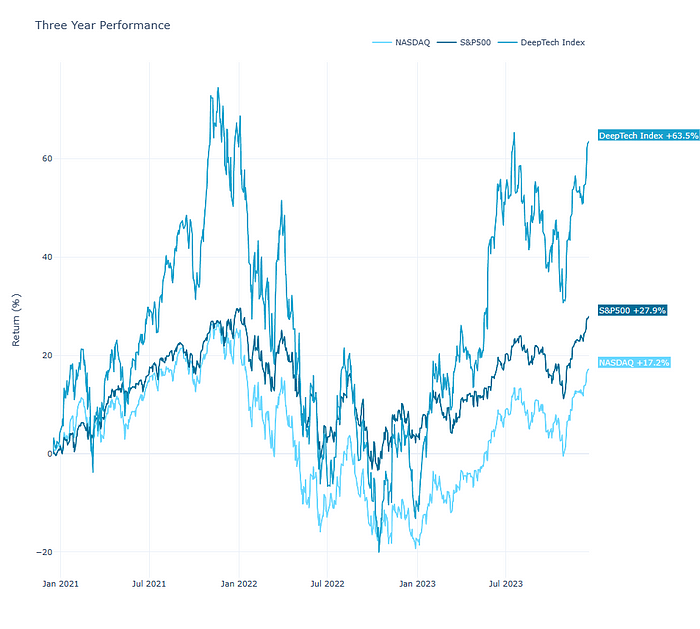

As we moved through 2023, we likely witnessed a market bottoming out, with many US public DT companies experiencing significant value reductions. However, by year-end, the narrative shifted, driven by a resurgence led by major tech players focusing on AI innovations, particularly NVIDIA's outstanding performance.

The last six months of the year saw a notable rebound in publicly listed DT firms, largely spurred by big tech investments in AI. This surge in interest attracted funding to early-stage startups not only in generative AI but across various sectors, including advanced materials and cybersecurity.

In addition, the recalibration of public markets has created a unique environment for investors. The trickle-down effects from 2022 to 2023 have led to decreased early-stage valuations, as founders grapple with sunk costs. The decline of the 'growth at all costs' mentality has resulted in many startups struggling to maintain previous valuations, leading to a series of 'at' and 'down' funding rounds throughout the year.

One of the most striking observations this year is that DT has remained relatively stable compared to its software counterparts, which have faced broader challenges. Biotech, in particular, has experienced a resurgence at the early stages.

While biotech IPOs have decreased since 2021, the current LOE period from 2023 to 2030 has catalyzed M&A activity. Biopharma companies, facing significant potential revenue losses, have begun to recycle assets through new acquisitions. Notably, high-quality R&D has persisted this year, with pharmaceutical companies moving earlier in the market than ever for high-value assets. The remarkable success of drugs like Wegovy and Ozempic has drawn additional capital toward upstream R&D, with numerous comparable drugs currently in the pipeline.