Global Business Week: Analyzing $2.5 Trillion in Private Equity Reserves

Written on

Market Trends Overview

In the latest business roundup, major stock indices experienced moderate gains last Friday, marking a robust performance over three consecutive weeks. This positive momentum was primarily driven by a decline in Treasury yields, which fell due to unexpectedly low U.S. inflation data. Investors are increasingly optimistic that the Federal Reserve's cycle of interest rate hikes may be coming to an end. The yield on the 10-year Treasury note dropped by 19 basis points, settling at 4.44%.

During the past week, the Dow Jones index saw a rise of 1.9%, the S&P 500 increased by 2.2%, and the Nasdaq Composite gained 2.4%. Cumulatively, over the last three weeks, the Dow surged by 7.8%, the S&P 500 by 9.6%, and the Nasdaq by an impressive 11.7%. The week concluded with the 10-year Treasury yield at 4.44%, while the 2-year yield stood at 4.90%.

The US Dollar faced its most challenging week since July, declining by 1.60% to close at 103.90 in the US Dollar Index. This drop was driven by soft inflation figures and tepid economic activity in the U.S. A review of the daily chart indicates a bearish technical outlook for the DXY, with sellers dominating, suggesting potential further declines. The Relative Strength Index (RSI) currently trends below the midline, indicating a bearish perspective, while the MACD histogram shows an increase in red bars. The index is positioned below the 20 and 100-day Simple Moving Averages, reinforcing a negative outlook for the USD. Key support levels are seen at 103.80, 103.60 (200-day SMA), and 103.30, with resistance levels at 104.15 (100-day SMA), 104.50, and 105.00.

Cryptocurrency Performance

On Thursday, the leading cryptocurrency experienced a remarkable rise of $3,000 in just one day, hitting an 18-month peak at $38,000. However, similar to previous attempts to surpass this level, bearish pressure quickly emerged, stalling further gains. While many altcoins recently reached significant local highs, the current landscape has dramatically shifted, with declines dominating the charts.

Following BlackRock's formal filing for a spot Ethereum (ETH) ETF, Ethereum's price surged to $2,100. However, it soon fell back, now trading $200 below that peak. Other major cryptocurrencies, such as Binance Coin, Tron, Ripple, Bitcoin Cash, Shiba Inu, Litecoin, and Toncoin, have also faced declines of about 2–3% in the past 24 hours. Additional losses were observed in Solana, Cardano, Chainlink, MATIC, and DOT, with some experiencing declines of up to 8%.

Private Equity Landscape

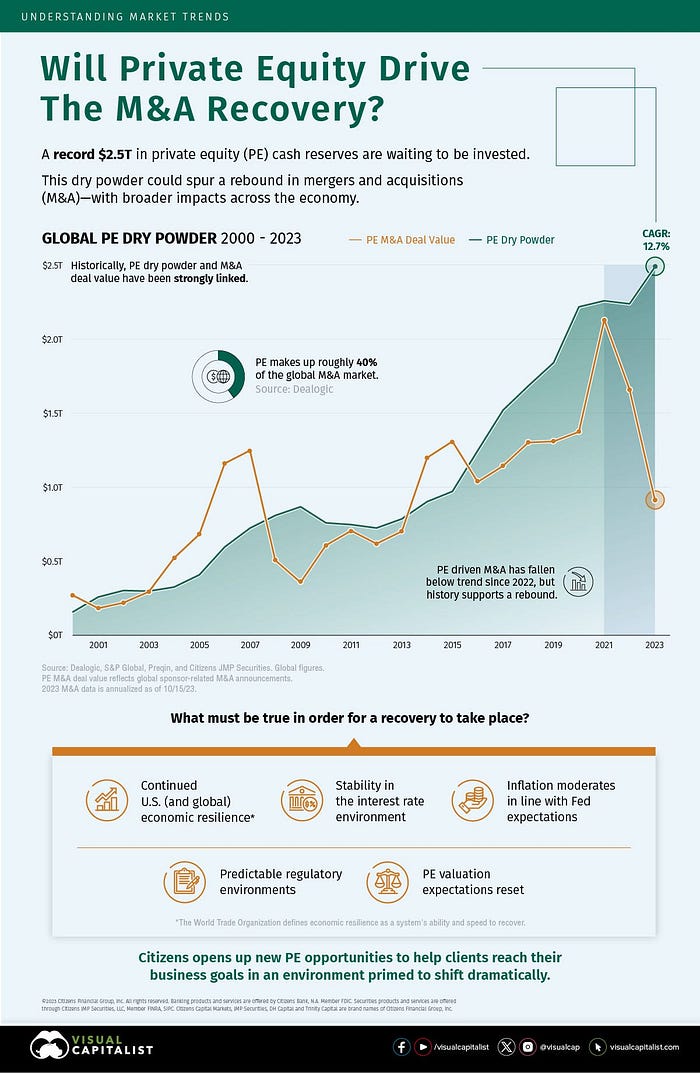

Private equity firms, which focus on investing in non-public companies, currently possess a staggering $2.5 trillion in cash reserves. This substantial pool of funds is typically used by PE firms to acquire private companies with growth potential, aiming to improve their valuations. Historically, higher cash reserves have been linked to increased PE deal activity.

Despite this impressive cash reserve, actual deal-making activity has been lackluster. The current economic landscape, characterized by multi-decade high interest rates and uncertainty, has caused mergers and acquisitions to drop to a 10-year low. The infographic presented by Citizens illustrates the historical rise of cash reserves and discusses potential catalysts for a revival in M&A activity.

Market Statistics Summary

Before delving into further statistics, let’s take a look at the weekly and year-to-date numbers from various markets and assets.

Bitcoin Adoption Trends

The accompanying graph illustrates a significant increase in blockchain addresses holding at least $1,000 worth of Bitcoin (BTC), closely mirroring BTC's price trends. On November 15, the total reached a record high of 8,306,118, surpassing the previous peak from two years ago. It is important to note that despite this surge in address activity, Bitcoin's price remains 89% lower than its peak of $69,000 from November 2021.

Tech Valuations Insights

Recent insights from CB Insights regarding tech valuations reveal that median valuations have increased across all stages quarter-over-quarter (QoQ). Notably, Series C and Series D+ startups saw the most substantial growth, with increases of 54% and 43%, respectively. Although median valuations for Series A and B startups declined year-over-year in Q3, seed/angel, Series C, and Series D+ startups all recorded increases during the same period. Late-stage deal volume saw a slight QoQ rise but is on track to reach 436 for the full year, reflecting a 39% decrease from 2022. This trend highlights investors' cautious approach amidst market instability and high-profile bankruptcies in late-stage companies.

... and so on with additional sections covering trade flows, startup valuations, CEO departures, and the tech M&A landscape.