Warren Buffett's Insight on Climate Change Investments

Written on

Chapter 1: Key Lessons from Warren Buffett

During the recent Berkshire Hathaway shareholder meeting, a significant lesson emerged: effective investors focus on areas where they possess a competitive advantage. Both Buffett and Munger faced inquiries about investing in sectors outside their current portfolios. Their straightforward response was, "To make any investment, we must consider: what insights do we have that others lack?" Those who hold unique knowledge or insights can gain a considerable edge in investing. In this piece, we will explore promising opportunities within the climate change sector.

Making Profits in Climate Change: The Surprising Beneficiaries

Electricity Transmission

The prevailing narrative in the battle against climate change emphasizes the need to "Electrify Everything." This movement extends well beyond appealing electric vehicles like those from Tesla. It is anticipated that the demand for electricity will triple in the coming decades. Stakeholders recognize that the electricity generation sector is complex, with solar, wind, nuclear, and hydro sources competing to reduce costs while ensuring reliability. Conversely, the electricity transmission and distribution arena is more streamlined, often regulated and monopolized in various regions.

A return to Berkshire’s meeting revealed the vast economic potential of efficiently transporting green electricity from generation sites to consumption areas. Professionals in this field understand that significant challenges can arise from a rapid increase in generation capacity, particularly given the current structure of electric grids. The potential for cross-continental transmission lines could be as transformative for Berkshire as railroads were in the past. Consequently, many electricity transmission and distribution companies stand to benefit significantly from this reality.

Heating Solutions

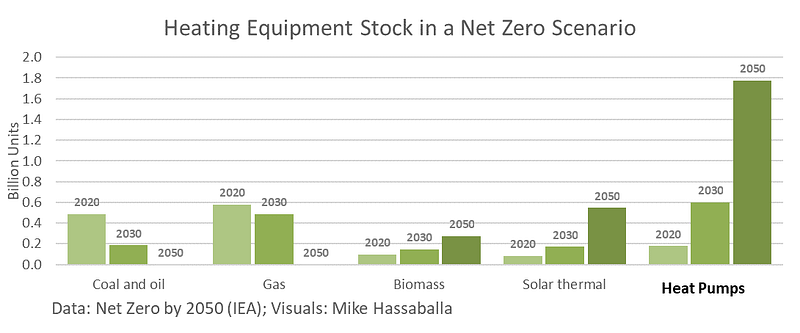

Buildings are responsible for approximately 40% of global carbon emissions, primarily due to reliance on fossil fuels for heating in colder regions. However, electricity can serve as a cleaner alternative. The most effective method for heating buildings is through heat pump technology. These machines are far more efficient than traditional electric heaters. Projections indicate that billions of heat pump units will be needed over the next few decades to replace existing fossil fuel heating systems. This trend suggests substantial economic opportunities for manufacturers of these devices, as shown in the following figure illustrating expected sales by 2050.

Rare Earth Metals

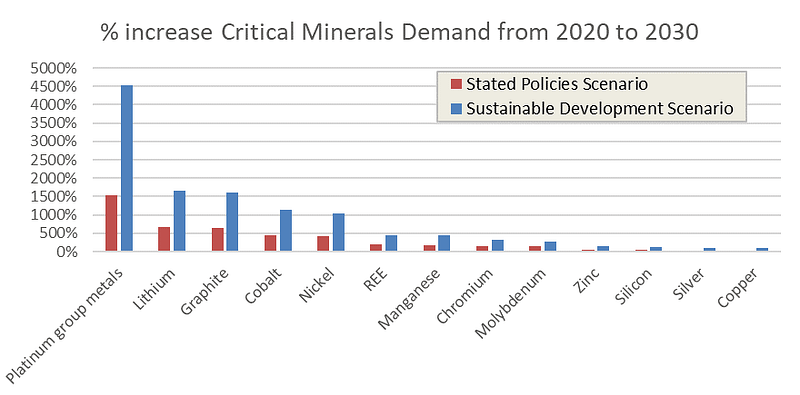

To generate clean energy for the future, the production of generation equipment relies heavily on rare earth elements. The anticipated demand for these metals, particularly Platinum Group Metals, is expected to outstrip current production capabilities by several multiples. The chart below outlines the projected increases in demand based on existing and potential sustainable policies. Upon reviewing this data, the staggering projected demand growth—some metals could see increases of up to 1500%—is remarkable. This presents significant economic prospects for companies involved in mining these essential resources, while also posing challenges in meeting such demand, potentially driving innovation in both extraction and recycling processes.

Chapter 2: Insights from Warren Buffett on Climate Change

In this video, Warren Buffett discusses his perspective on climate change and why he remains unconcerned about its impact on investment strategies.

Buffett elaborates on the implications of climate change for the insurance industry, providing valuable insights into how it affects risk assessment and investment decisions.

If you found this information useful or enlightening, feel free to follow my updates. For any questions, feedback, or support, please reach out.