Empowering Dreams: My Year of Micro-Lending and Philanthropy

Written on

Chapter 1: The Evolution of My Donation Habit

Reflecting on my involvement in micro-lending over the past year, I realize my journey began with a long-standing habit of donating. For over a decade, I’ve actively contributed to various causes, and recently, I’ve combined my donations with micro-lending to enhance the impact of my charitable efforts.

To understand this transition, it's essential to examine how my donation practices developed. Typically, I select three to five organizations annually, researching their missions and activities before committing my support. My donations often lead to follow-up contributions to those with consistent performance, while I’ve ceased support for others that failed to deliver results.

Analyzing my donation patterns, I've identified three primary categories of giving:

- One-third to globally recognized causes and organizations

- One-third to local initiatives in communities where I've lived

- One-third to distinctive causes that resonate with me emotionally

Although I'm not affluent, my wife and I prioritize giving back. The cumulative effect of consistent donations over the years has been rewarding, as we feel a connection to the organizations we support. In some instances, our contributions contribute to long-standing legacies and successes.

Through this journey, I've gained insights about myself, particularly regarding my donation preferences. For instance:

- I tend to avoid organizations focused mainly on policy issues, engaging only when my core values are significantly challenged.

- I am drawn to innovative programs that occupy unique niches.

- Consistency in communication and measurable impact is vital; I value strong leadership and effective management.

- I prioritize data over marketing, seeking concrete information rather than emotional appeals.

Two organizations that exemplify these principles are:

- Blessings In A Backpack: This initiative addresses food insecurity for children who depend on school meals, ensuring they have access to food during weekends and school breaks. It has expanded to 48 states in the U.S., effectively tackling issues of education, food supply, and poverty.

- The Ocean Cleanup: This organization originated with a simple idea and has since developed innovative methods to capture plastic waste before it enters oceans, aiming to address the Great Pacific Garbage Patch and making strides on a global scale.

I initiated my micro-lending journey with a $200 investment through Kiva, a popular micro-lending platform.

Micro-lending is essentially about providing small, unsecured loans to individuals who lack access to conventional financial services, often due to poverty or geographic barriers. This model, which began in developing nations, aims to empower individuals to establish small businesses, thus helping them escape poverty.

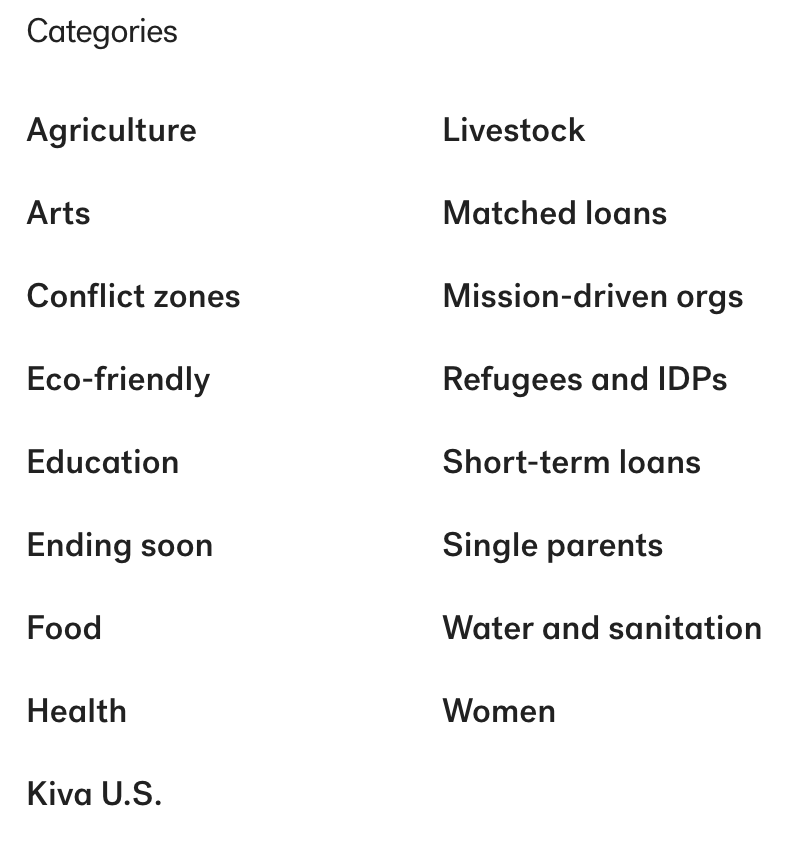

Upon logging into Kiva, I was astonished by the variety of loan categories available. It prompted me to consider: What type of loans do I want to fund, and what matters most to me in this process?

Exploring Micro-Lending Categories

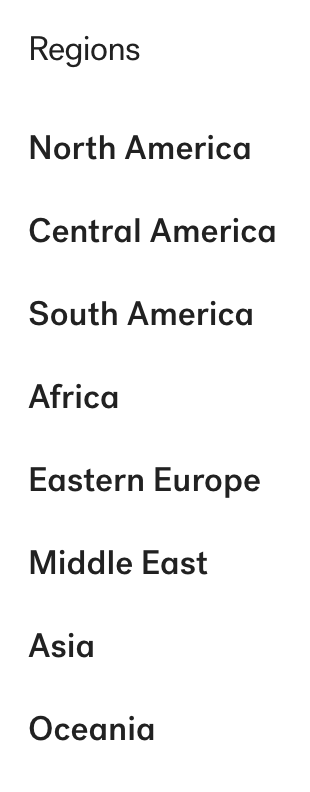

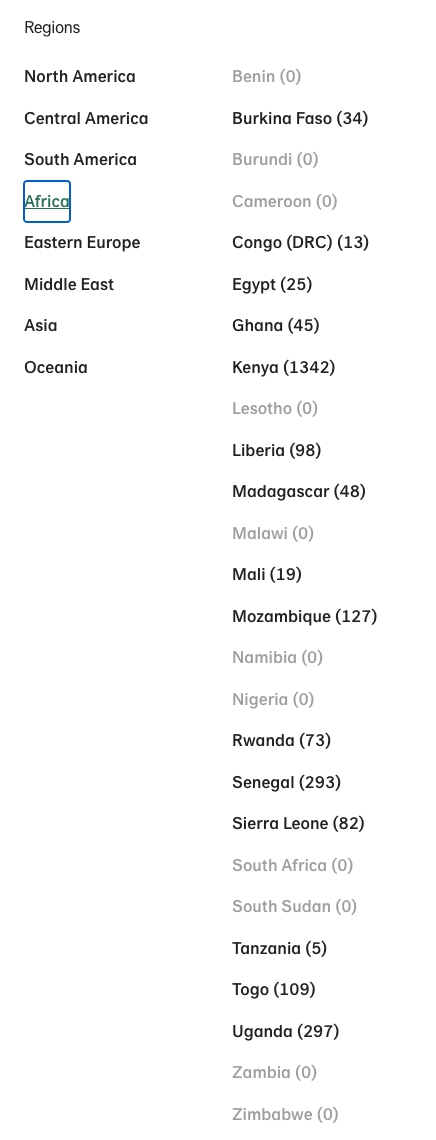

After exploring the categories, I delved into regional options. Which areas do I want to support?

After spending several hours researching, I decided to focus on investing in women entrepreneurs. I realized that I was less concerned with the specific loan category and more interested in the purpose of the loan.

For instance, I found I couldn't relate to loans aimed at purchasing seeds or fertilizers, which are common. Instead, I was drawn to loans for tangible needs such as:

- Constructing a dam for livestock to access water during summer droughts

- Acquiring land for farming

- Purchasing ovens for cooking

- Investing in bio-reactors for producing cooking gas from manure

- Buying rickshaws for delivering water

Each of these investments represented a concrete enhancement to someone's business, and the fact that I was supporting women entrepreneurs was particularly gratifying.

After my initial round of lending and a few months of observation, I decided to add another $500 to my lending portfolio and focus on a specific geographic area. However, I soon realized that this region had limited opportunities for women entrepreneurs. Faced with this challenge, I had to choose between investing larger amounts in fewer individuals or broadening my scope to support any entrepreneur needing infrastructure.

I opted to concentrate on lending for infrastructure while keeping the loan amounts manageable ($50 to $75 each), preferring to be part of a group of 10 to 30 lenders supporting a single entrepreneur.

One Year of Micro-Lending: Reflections

Now, a year into my micro-lending journey, I have funded 14 projects, with one loan repaid early. I monitor my portfolio monthly, and I’ve noticed a new trend: second loans from entrepreneurs looking to expand after their initial success. This has been particularly rewarding, with examples including a woman in Kazakhstan purchasing additional land and another expanding her dairy farm.

Overall, my micro-lending experience has been both enjoyable and enlightening. It offers a unique perspective on global entrepreneurship while contributing to meaningful change. Each loan tells a story, allowing me to forge a personal connection with the dreams and aspirations of others.

About Me

I am a dedicated product executive and technologist with 25 years of experience in the technology sector, spanning Fortune 500 companies, private equity, joint ventures, and startups. Alongside my professional endeavors, I am a passionate writer whose interests encompass a wide array of subjects, including art, history, philosophy, and technology. My diverse interests enrich my professional insights and foster creativity in my work.

My expertise includes B2B2C SaaS, Cloud, Mobile, Security, Fintech, Machine Learning, and Virtualization, with a track record of leading product portfolios generating over $300M in revenue. I have deployed technology to hundreds of millions of users, authored two books, hold several patents, and actively speak at various conferences. I possess an MS in Finance and an MBA from Northeastern University, along with multiple technical certifications. Currently, I serve as an SVP of Product and Design at a B2B2C company, impacting over 25 million users and 10,000 businesses.

Chapter 2: Insights from Micro-Lending

In the first video, "Moonwalking into 2024 with SBA Expert Sherry Martin | Ep. 130 | The Art of SBA Lending," Sherry discusses the nuances of small business administration lending and how to navigate the landscape effectively.

The second video, "#124 More Than One Way to Live | Jacqueline Novogratz (Founder, Acumen)," highlights Jacqueline's insights on social entrepreneurship and the diverse pathways individuals can take to create meaningful change in the world.