Navigating the Current Landscape of the Tech Industry in 2024

Written on

The State of the Tech Industry: A Closer Look

The tech industry is facing an unprecedented period of upheaval. With significant layoffs, a drastic decline in venture capital investment, and ongoing debates about whether this represents a crash, many are left wondering about the underlying causes and the potential outcomes of this turmoil.

Disclaimer: This article generalizes the diverse tech landscape, and does not delve into specific challenges within various segments. Readers are encouraged to share their perspectives in the comments.

As of now, data from Layoffs.fyi indicates that since March 2020, around 120,000 individuals have lost their jobs in startups worldwide. Over 700 startups at various funding stages have reduced their workforce by anywhere from 1% to 100%. Some observers are quick to assert that "the tech market is crashing."

In the first quarter of 2022, venture capital investments saw a 19% quarter-over-quarter decline, marking the steepest drop since 2018. The Nasdaq, a key indicator of U.S. tech stocks, has plummeted over 27% since January 2022. Many believe "the tech market is crashing."

While the situation is indeed challenging, it is not yet a complete collapse. Buckle up as we delve deeper into the intricacies of this issue.

For those interested in a more optimistic perspective on the aftermath of this crisis, I invite you to read my follow-up article: "Silicon Valley Crisis and the Tech Diaspora."

Understanding the Path to Today

It's clear that the tech industry had spiraled out of control. Over the last decade, nearly every startup achieved "unicorn" status, often securing millions in seed funding without a tangible product or established team. While the "real world" economy has struggled post-pandemic, tech companies flourished, basking in the opportunities presented by the so-called "new normal."

Although COVID-19 accelerated technological adoption across various sectors, the anticipated "new normal" did not materialize as expected. As restrictions eased, the industry faced challenges such as disrupted supply chains, soaring oil prices, and geopolitical tensions. Despite a booming tech sector, the consumer market has been grappling with inflation, rising unemployment, and mental health issues for nearly three years. What initially appeared to be a swift economic recovery has now turned into unmet expectations for a brighter future.

Consumers are now more judicious in their spending. Subscribing to Netflix instead of purchasing groceries seems impractical when free options are available. Prospective homebuyers are postponing purchases, waiting for more favorable mortgage rates, regardless of the appeal of real estate apps. With basic expenses taking precedence, traditional strategies like Product Led Growth (PLG) are losing their effectiveness.

Investment Trends and the Myth of Exponential Growth

Historically, tech companies operated under the assumption that a lack of exponential revenue growth would lead to failure. The concept of exponential growth implies that organizations should be able to achieve significantly greater impact with fewer resources. As Salim Ismail puts it, an Exponential Organization (ExO) achieves an output at least ten times larger than its peers.

In theory, this is appealing, but the reality for many tech firms has diverged significantly from this ideal.

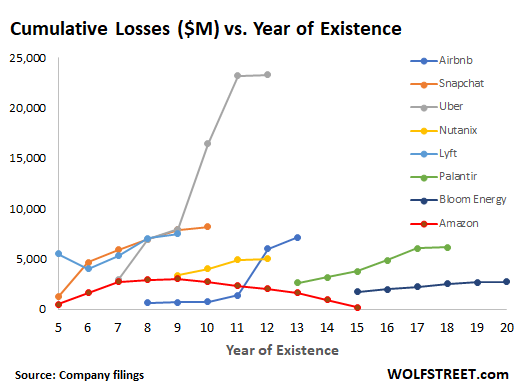

Growth—often not even exponential—has largely been fueled by investments rather than sustainable practices. Companies have resorted to hiring large teams to tackle challenges in pursuit of scale. For instance, if a company launches a prime-time television ad, they may feel compelled to assemble a full closing team. The focus has been on rapid growth rather than profitability, with many firms relying on showcasing revenue increases to attract further funding.

However, the landscape has shifted. The earlier graph illustrates that even industry giants continued to operate at a loss, despite being well beyond their initial stages of market acquisition. While size is an important metric, stability is equally crucial, and many startups resemble fragile constructs. When funding dries up, these companies lack a solid foundation to sustain operations.

Interest Rates and Market Conditions

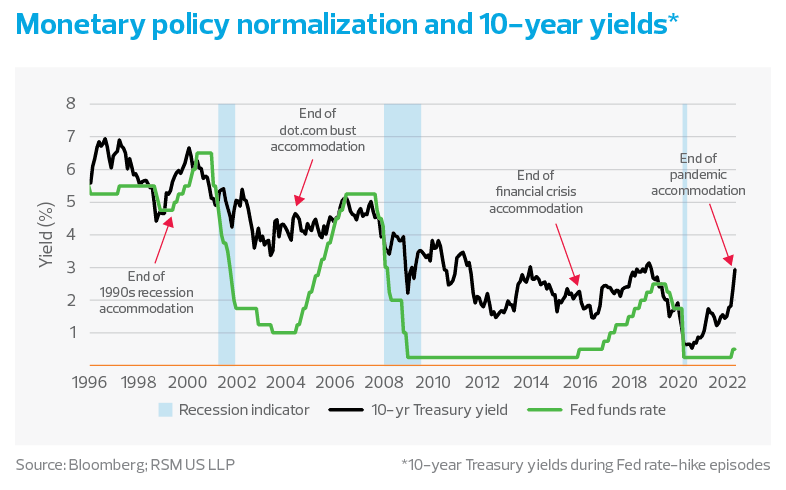

We find ourselves in challenging times, characterized by high interest rates responding to rising inflation. Investors are often hesitant to deploy capital, preferring to keep their money in the bank. This sentiment, while understandable, oversimplifies a more complex scenario.

The U.S. Federal Reserve (FED) serves as a bellwether for global economic trends. Given that a significant portion of tech investment originates in North America, U.S. Treasury bonds are viewed as the safest investment globally. Acquiring American debt is perceived as a reliable way to ensure returns.

When examining the graph above, it becomes apparent that FED interest rates are relatively low, and yields on 10+ year bonds are comparable to 2018 levels, a time when layoffs were not prevalent. So, what accounts for the current atmosphere?

The details are intricate and extend beyond the scope of this article, but the crux of the matter is that bond yields are rising due to decreased demand or expectations of prolonged inflation. Investors are not simply avoiding risk for ease; they are strategizing to protect their capital from diminishing returns in the face of inflation.

Not a Crash, But a Soft Landing

I've shared a wealth of information, so let's summarize:

- Consumers are reconsidering their spending habits, which is impacting revenues.

- Tech companies at all stages have been overspending on hiring to boost revenues without ensuring profitability.

- Investors anticipate that inflation will persist, undermining future investment returns.

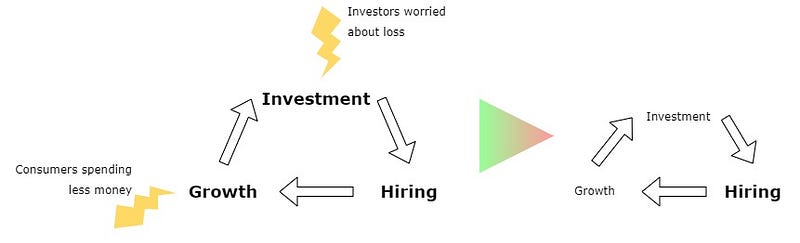

This environment of inflation—felt by both consumers and investors—is constricting a previously robust cycle of investment, hiring, and growth. The interconnected nature of these factors means that with concerned investors and decreased consumer spending, the cycle tightens, necessitating a corresponding reduction in hiring.

Adapting Hiring Practices to New Realities

Typically, investors back startups with a long-term view, hoping for substantial returns when the company goes public or is acquired. Under such circumstances, burning through cash can be acceptable. However, what happens when the timeline for returns stretches indefinitely? If the prospect of recovery seems dim, investors may demand immediate returns.

This is precisely why the market isn't crashing; rather, it is recalibrating. Capital isn't fleeing the tech sector; it is simply anticipating a shift. The industry is recognizing the need to reinstate moderation and return to profitability.

As companies assess their staffing needs, they must be cautious about costs. In a previously inflated tech sector, salaries for roles such as engineers, product managers, and designers have surged—often 100% higher than similar positions. If businesses aim to prioritize profitability, they must carefully consider their hiring strategies to avoid excessive spending.

Looking Ahead: Speculations for the Future

Any predictions from this point forward are speculative. Throughout my research, I encountered a variety of insightful articles. While some are cited, others remain unmentioned. A recurring theme suggests we are entering a phase of adjustment that could persist for some time.

The number of large corporations implementing significant layoffs seems limited. For instance, Netflix's decision to let go of 100 employees, while newsworthy, represents only 1% of its total workforce. Many larger companies appear to be opting for a hiring freeze rather than mass layoffs.

Conversely, smaller startups that have surpassed the seed stage may face greater challenges. Lacking the structural maturity and product viability to generate sufficient profits, many may not survive.

Ongoing layoffs are likely in the near future, potentially affecting well-known companies like Meta or Amazon. While it is unlikely that any major player in the industry will experience a collapse akin to the dot-com bust, a noticeable market contraction is expected.

For those currently employed, consider your options carefully before making any moves. If you've recently lost your job, act swiftly, as opportunities still exist. If you're contemplating a tech career, it might be wise to wait until the situation stabilizes. And if you're considering launching a startup, I commend your ambition—best of luck.

The State Of The Tech Industry In 2023

The tech industry is undergoing significant transformations, marked by layoffs and investment challenges. This video provides insights into the current state of the sector and its potential future.

What the Hell is Happening to America? - Mike Solana

Mike Solana discusses the broader implications of current trends in America, including the tech industry’s challenges. This conversation sheds light on the societal impacts of these shifts.